Planning to buy Sovereign Gold Bonds in the Secondary market?

Gold has done very well over the past couple of years. If you want to invest in gold, there are many ways to take exposure. You can buy physical gold or gold jewellery. You can in gold ETFs, gold mutual funds and Sovereign Gold Bonds.

Investing in Sovereign Gold Bonds (SGB) has certain limitations but SGBs are my preferred way to invest in Gold. Do note this is not a recommendation to increase exposure to gold. That is your asset allocation decision.

RBI issues Sovereign Gold bonds every month. You can subscribe to those primary issues. Alternatively, you can also buy Sovereign Gold Bond issues in the secondary market, likely at a discount.

If you plan to buy Sovereign Gold Bonds in the secondary markets, here a few things that you must keep in mind.

Secondary market in Sovereign Gold Bonds is a Buyer’s market

- As a buyer, you can buy gold bonds in any of the over 42 tranches issued by the Reserve Bank. For all the bonds, the underlying is the same.

- As a seller, you can only sell the bond you hold.

- RBI comes out with a Sovereign Gold Bond issue every month (earlier, it was quarterly). Hence, the buyer has little incentive to buy from the secondary market unless he gets a good discount on the RBI issue price.

- In fact, on most days, gold bonds sell at a discount to even IBJA gold price. We know that IBJA gold does not offer any interest. SGBs offer interest income. Despite this, gold bonds trade at a discount. Hence, as a buyer, you can get a good deal.

- Different issues have varying liquidity. Hence, you may be able to find a higher discount in less liquid issues.

- Remember, once you have bought, you are a potential seller. The role reverses. Keep this aspect in mind. This is not a problem if you want to hold until bond maturity.

- If you subscribe to SGB primary issues, you will get bonds that mature in 8 years (even though you can redeem every 6 months from the end of the fifth year). On the secondary markets, you can buy bonds that mature in as early as 2023.

Where do I start?

At what price, should you place your buy bid?

The subscription price of gold bonds is linked to the price of 999 purity gold at IBJA (Indian Bullion and Jewellers Association). The indicative rates are published on IBJA website daily.

As a buyer, you can use this price as the reference point and place your bid accordingly. Remember, for the reasons mentioned in the previous section, you will get a discount over IBJA price (999 purity gold).

There is data on MoneyControl about Gold futures price. I do not completely understand how to use the information. Perhaps, if the gold futures are down, you can expect sellers in the Gold Bond market to be more desperate to sell.

Lower Bond price is not always the best deal

The interest rate of 2.5% p.a. (or 2.75% in the initial tranches) is applicable on the subscription price (and not the trade price in the secondary market). Since the subscription price for various tranches is different, the interest quantum varies too. You must consider this when you place the buy bid.

Let us understand this with the help of an example.

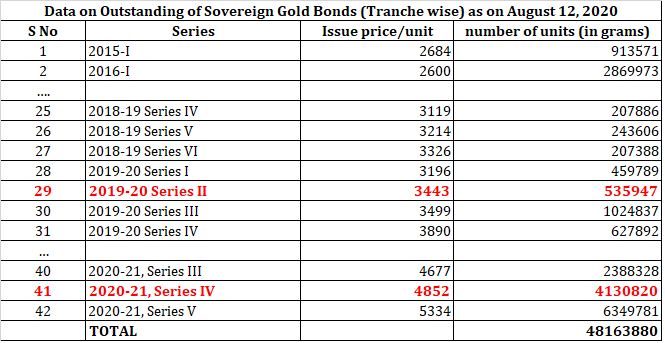

RBI has collated the price of all the previous tranches at one place. You can download the file from RBI website and check.

Source: RBI website

Source: RBI website

For instance, let us consider the following two tranches.

- SGB 2019-20 Series II (Issued in July 2019 and Matures in July 2027): Subscription price: 3,443 per unit

- SGB 2020-21 Series IV (Issued in July 2020 and Matures in July 2028): Subscription price: 4,852 per unit

While the underlying is exactly the same in both the cases (999 purity gold), the quantum of interest pay-out will be different.

Bond 1 (SGB 2019-20 Series II) will pay an annual interest of Rs. 86 (Rs 3,443 X 2.5%)

Bond 2 (SGB 2020-21 Series IV) will pay an annual interest of Rs 121. (Rs 4852 X 2.5%)

That is a difference of Rs 35 per unit per annum for 7 years. Not much However, you may be buying 100 units. In that case, the difference will be Rs 3,500 per annum. Over the next 7 years, this will be Rs 246.5 for 1 unit. For 100 units, the difference will be Rs 24,657 over 7 years.

Bond 1 matures in about 7 years while the Bond 2 matures in about 8 years. However, since there is an option to redeem SGBs with RBI every 6 months from the end of fifth year, I will ignore this difference.

Now, if both the bonds are available in the secondary market at the same price (the ask price is same for both the bonds), which one would you buy?

Obviously, the Bond 2 (SGB 2020-21 Series IV) because it will pay me more interest.

What should be the difference in purchase price?

Now, this bit is slightly tricky.

Not only the cashflows but their timing can be different. For instance, the bond issued in April will pay interest in October and April. The bond issued in July will pay interest in January and July.

More importantly, at what rate do you discount those cashflows?

In the example I considered, at least the subscription months are the same (July 2019 and July 2020).

I know that there is interest difference of Rs 17.5 every 6 months (Rs 35 per year/2) for the next 7 years.

I do not want to get into complicated valuation and assess what the idea discount rate should be. I do not know how to do that either. Let us discount this interest difference of Rs 17.5 every six months at 6% p.a. The present value of the interest differential at 6% p.a. is ~ Rs. 199.

Hence, if the Bond 2 (SGB 2020-21 Series IV) is available at Rs 5,000 per unit, I would not place the buy bid for the Bond 1 (SGB 2019-20 Series II) at more than Rs 4,801. Do note this is as on today. As the time goes on and bonds move closer to maturity, the difference will drop (since some interest would have already been paid from the bonds).

By the way, when I say the Bond 2 is available at a certain price, I mean that there is a seller willing to sell at that price.

Note that interest income from SGBs will be taxed at your slab rate. I have not considered the impact of taxation in this post. But, let us say if you are in 30% bracket, the actual interest differential will be lower. For instance, in this example, the present value of post-tax interest difference will be Rs 139 (and not Rs 199).

The accrued interest in a particular bond will also play a role in your buy bid. However, this will automatically be covered when you do present value calculations for the interest amount.

The mistake I made

SGB 2020-21 Series V (issued in August 2020 and matures in August 2028) was open from subscription from August 3 until August 7. Subscription price was Rs 5,334. With online discount, I could have subscribed at Rs 5,284 per unit. Let us call this Bond 3.

During the same week, I bought SGB 2020-21 Series IV (issued in July 2020 and matures in July 2028) at Rs 5,240 on the secondary market. I thought I got a good discount of Rs 44 per unit. Let us call this Bond 4.

Not too smart though.

Bond 4 (SGB 2020-21 Series IV) had a subscription price of Rs 4,852. That is an annual interest of 121.33.

Bond 3 (SGB 2021-21 Series V) had a subscription price of Rs 5,334. That is an annual interest of 133.35.

Therefore, Bond 3 pays Rs 12.02 more per unit per annum.

If I ignore accrued interest for 1 month for Bond 4 and the difference in cashflow timings and the discount the difference at 6% p.a., the present value of the difference comes to Rs 68.

Thus, I should have placed the buy bid around Rs 5,210-Rs 5,220. I bought at Rs 5,240.

I would have been better off subscribing for the bond 3 (maturing in August 2028) at Rs 5,284.

I did not buy a big amount. Moreover, the tax on interest reduces the difference between the ideal bid and my bid even further. So, does not matter much. However, I did not think through these points when I bought the bonds.

The issues in trading in Sovereign Gold Bonds

The liquidity is low for most issues. There can be big difference in trade price across bonds and between the best bid and ask prices. Just look at the following two SGB issues and the best offer prices. Remember SGBOCT25 offers much lower interest income but still the best offer (or ask) price is much higher than SGBJUL28. I understand SGBOCT25 has accrued interest but that does not explain the difference.

Many tranches of Sovereign Gold Bonds have been issued in the market. Each is different when it comes to trading and cashflows. Each has a different trading symbol.

You can get the trading details about all the tranches on NSE website. However, NSE website does not provide you the Best Ask price (the price at which you can buy the bond on the exchange). You will have to check trading symbol to figure that out. That is cumbersome.

You need to check the ask price (best sell price) of the bonds and compare the various bids (due to the difference in interest quantum). And thereafter, you can decide which bond to buy and how much to bid. Remember, you will also pay brokerage when you buy/sell in the secondary market.

Misconception about SGB taxation

I have received queries about taxation of SGBs if you buy in the secondary market. A few investors are under the impression that redemption of SGBs is not exempt from capital gains tax if the bonds are bought in the secondary market.

That is not true.

I copy an extract from Section 47 of the Income Tax Act (Transactions not regarded as transfer)

(viic) any transfer of Sovereign Gold Bond issued by the Reserve Bank of India under the Sovereign Gold Bond Scheme, 2015, by way of redemption, by an assessee being an individual;

Notice the word “redemption”.

How you buy the Sovereign Gold Bond does not matter. You could have bought the bonds in the primary issue or in the secondary market. It has no effect on taxation.

How you sell/redeem the bonds matters. If you redeem the bond with the RBI at the time of maturity, then there is no capital gains liability. You get an option to redeem the bond with the Reserve Bank every 6 months from the end of 5th year. If you exercise the option, there shall be no capital gains tax liability in that case too.

If you sell the SGB in the secondary markets, you might have to pay capital gains tax.

You buy the bonds in the primary market and redeem with the RBI: No capital gains tax

You buy the bonds in the secondary market and redeem with the RBI: No capital gains tax

You buy the bonds in the primary market and sell in the secondary market: Capital gains tax implications will be there.

You buy the bonds in the secondary market and sell in the secondary market: Capital gains tax implications will be there.

What is the rationale for such tax treatment?

The reason is that the Government wanted to make the tax treatment of gold bonds like the taxation for physical gold or jewellery.

Now, you can buy physical gold today and not sell for 50 years. There will be no capital gains liability.

However, SGBs mature in 8 years. If the maturity proceeds were taxable, this would have reduced the attractiveness of SGB as a gold investment. Even rolling over into another issue of SGBs would have had tax costs. Hence, such beneficial treatment for SGBs if you redeem with the Reserve Bank.

If you sell in the secondary markets, you are perhaps just a trader and hence no beneficial treatment.